Top Sports News

Exclusive: Panthers Legend Luke Kuechly Raves About Bryce Young, Talks No. 8 Pick

Carolina Panthers great Luke Kuechly believes we learned a lot about Bryce Young’s “makeup” and growth in his second season compared to his first. The No. 1 overall pick in…

Jordan Love Exclusive: Star Quarterback Explains How Packers Can Get To Next Level

Green Bay Packers quarterback Jordan Love is well aware that the team — including himself — needs to improve if they want to get to an elite level. The Packers…

NFL

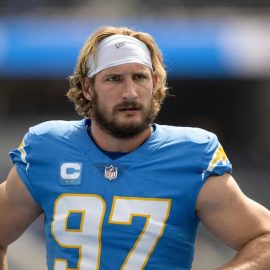

View allJoey Bosa signed a one-year, $12.6 million deal with Buffalo after nine seasons with the Chargers

With NFL free agency underway, teams are signing players for the 2025 season and beyond. On March 5, the Chargers cut ties with their longest-tenured player, Joey Bosa. He played…

Anthony Richardson and Daniel Jones will compete to be the Colts’ starter in 2025

In 2024, Anthony Richardson began the year as their starting QB. He played in 11 of their 17 games due to injury. Richardson has missed 19 games over his first…

NHL

View allColorado Avalanche General Manager Provides Update On Gabriel Landeskog’s Return From Injury

Colorado Avalanche General Manager (GM), Chris MacFarland, has given an update on the injury status of Gabriel Landeskog. Colorado Avalanche GM Gives Injury Update On Gabriel Landeskog The Colorado Avalanche…

Jessica Campbell and Emily Engel-Natzke Make History As First Female Coaches To Go Head-To-Head In NHL

Jessica Campbell and Emily Engel-Natzke have made history after becoming the first two female coaches to go head-to-head in the NHL. Jessica Campbell and Emily Engel-Natzke Make History In NHL…

Research Features

View allTop 10 Most Lucrative Wide Receiver Contracts Agreed Ahead Of The 2024 NFL Season

CeeDee Lamb landed one of the biggest non-quarterback deals in the NFL this week as he signed a four-year contract with Dallas – but where does the Cowboys star receiver…

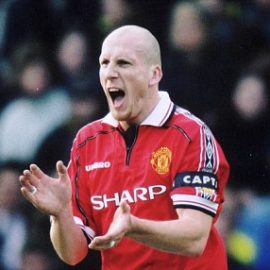

Premier League Summer Transfers: Top 10 Most Expensive Signings So Far

The 2024/25 Premier League season is almost upon us and as English clubs prepare for the new campaign, we are counting down the top ten most expensive transfers so far….