The collective sigh of relief across Merseyside this morning was tangible as supporters of Liverpool Football Club woke to the news that they have been incessantly clamouring for for nigh-on four years – or, at least, so it would seem.

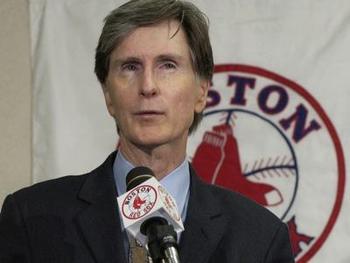

The more hyperbolic of this morning’s headlines are claiming that the club has been sold outright to New England Sports Ventures (NESV), the US consortium headed by John W Henry and current owners of the Boston Red Sox baseball franchise, but I’m afraid that the waters are much murkier than that.

According to a statement on the the club’s official website, widely reviled owners Tom Hicks and George Gillett attempted to stage one last boardroom coup in order to maintain their stay of execution at Anfield and, whilst the offer from NESV has been formally accepted by the club’s board, this further wave of top-level friction could prove to be detrimental to any prospective takeover bid – thus highlighting the chasm between the two factions that currently reside within the corridors of power.

The ball started rolling late on Tuesday afternoon, when a board meeting was called to discuss NESV’s offer.

Beforehand, Hicks and Gillett ventured to wrest back a controlling sway of the boardroom by forcibly removing current managing director Christian Purslow and commercial director Ian Ayre from their posts – claiming that, by mulling over NESV’s relatively low bid, the board hadn’t been acting in the best interests of the owners – and replacing them with Mack Hicks (Tom’s eldest son) and Lori Kay McCutcheon (financial controller at Hicks Holdings) respectively, thus instilling the American pair with the legal power to quash the sale.

The coup failed as the English contingent (Purslow, Ayre and chairman Martin Broughton) still have the majority vote as part of the conditions agreed upon when it was announced that Liverpool were to be floated on the stock market back in April, with the sole intention of the measures being that Hicks and Gillett couldn’t refuse to sell the club if bids failed to match their ridiculously lofty valuations (£600-800 million) – and therein lies the crux of the matter.

Rightly or wrongly, Hicks and Gillett are vehemently determined to somehow secure a return on their ownership of the club, and believe that NESV’s offer (reputed to be £300 million by The Guardian) grossly undervalues the club;

“In April, we confirmed our agreement to sell Liverpool Football Club, and stated our commitment to finding the right buyer for LFC, one that could support and sustain the club in the future. We remain committed to that goal.

The owners have invested more than $270 million in cash into the club, and during their tenure revenues have nearly doubled, investment in players has increased and the club is one of the most profitable in the EPL.

As such, the board has been presented with offers that we believe dramatically undervalue the club. To be clear, there is no change in our commitment to finding a buyer for Liverpool Football Club at a fair price that reflects the very significant investment we’ve made.

We will, however, resist any attempt to sell the club without due process or agreement by the owners.”

You’ve got to hand it to Hicks and Gillett, they’re nothing if not consistent. Amidst spiralling pressure, this resistance to a cut-price sale is an unwavering stance that they have held for some time now. Time for a little devil’s advocacy.

Like any second-rate businessmen, all they are now seeking is a maximum profit on an investment-turned-sour and, if their claims about increased turnover and revenue can be verified, then surely they are entitled to hold out for a windfall – regardless of the various constraints and animosity they are currently operating under.

They may have reneged on promises of new stadiums and various other untold and undelivered riches (as have many other owners of many of football clubs), but that’s not really grounds for a hostile takeover given that the figures seem to dictate that they may have actually performed fairly well within the confines of ‘business’ – monolithic debts not withstanding.

Anywhom, as a direct result of the actions taken by the American pair to prevent a swift exit, Liverpool board members Purslow, Ayre and Broughton will now consult their lawyers as to whether they can force through a sale on legal grounds due to the hostility they have encountered – with Broughton confident that NESV’s bid will ultimately be successful, although it will still be subject to the Premier League’s approval;

“I am delighted that we have been able to successfully conclude the sale process which has been thorough and extensive.

The Board decided to accept NESV’s proposal on the basis that it best met the criteria we set out originally for a suitable new owner. NESV’s philosophy is all about winning and they have fully demonstrated that at Red Sox.

We’ve met them in Boston, London and Liverpool over several weeks and I am immensely impressed with what they have achieved and with their vision for Liverpool Football Club.

By removing the burden of acquisition debt, this offer allows us to focus on investment in the team.

I am only disappointed that the owners have tried everything to prevent the deal from happening and that we need to go through legal proceedings in order to complete the sale.”

NESV’s bid is said to have also courted favour from the Royal Bank of Scotland (RBS), who are watching over proceedings with a keen eye given that they are Hicks and Gillett’s current lenders and are owed £237.4 million in unpaid debts – and plan to seize control of the club should they continue to resist a sale at a price that would cover their outstandings.

With their assets frozen and ‘toxic’, the threat of seizure looming and the intrinsic market value of the club dwindling on a daily basis, Hicks and Gillett are quickly running out of the the precious commodity that they seem to value above both morals and dignity at the moment…

Time.

Add Sportslens to your Google News Feed!