Derby County‘s inevitable relegation from the Premiership this May should be eased by the fact the Rams will start next season as one of the richest clubs in the Championship. The Pride Park outfit have been bought by an American consortium, led by Andy Appleby who runs the Detroit based General Sports and Entertainment for a reported £50m, giving the Americans a 93% stake in the East Midlands club.

The deal means four top flight clubs in England are now run by US investors, including Manchester United, Aston Villa and Liverpool. Stan Kroenke, the Missouri-born property magnate, also has a 12% stake in Arsenal.

The sale of some of England’s biggest clubs to foreign investors has proved something of a mixed blessing thus far – just ask Liverpool supporters. While every football fan dreams of being funded by a sugar daddy who shares their passion for their team, the reality is never so simple.

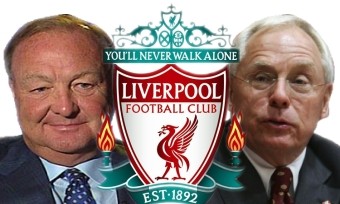

For some clubs, overseas investment seems to be working, such as at Aston Villa where Randy Learner paid off the club’s outstanding debt when he became chairman in a £63m buy out in August 2006. The team is moving in the right direction, challenging to be a genuine top six material this season and balancing the books off the park at the same time. Where as at Manchester United and Liverpool, fears are abound that the money Malcolm Glazer, Tom Hicks and George Gillett borrowed to take the helm at Old Trafford and Anfield respectively, could be to the long term detriment of the club’s stability.

.

Takeover History

17 years on from the formation of the Premiership and the league’s global on field attraction is spreading to the board room. Once upon a time, you would look at the newspaper sport pages to find it full of speculation of who would be the next big overseas player to ply his trade in the big league. Now media interest is equally dominated by talk of the next billionaire from abroad to pump an endless supply of cash into one of the 92 professional clubs in the country.

Manchester United have declared themselves as the world’s richest football club, despite a number of recent financial reports on football suggesting that title belongs to Real Madrid. They claim that their recent financial figures take them above the Spanish giants, which show United as making a gross revenue of £245m in the year to June 2007, seeing a massive 93% rise in profits on the previous year to £59.6m. The Old Trafford club are seeking to build even greater revenue in 2008 and currently embarking on a marketing mission to gain a host of global sponsors. If Manchester United’s estimation on how many fans they have worldwide is correct – chief executive David Gill says they have 333 million, with 139 million ‘active’ fans and 83 million based in Asia. The Eastern market is certainly one the club feel they can tap in to and would no doubt welcome the Premiership’s proposals to play a host of overseas league games to build on this.

While Manchester United can celebrate the fact they are the highest revenue generating football club in the world, it also must be taken into account they are carrying a huge debt on their shoulders. A refinancing deal 18 months into Malcolm Glazer’s reign at Old Trafford saw the figure United owe to the bank rise to £660m. Though the club urged fans that their annual interest charge would fall to £62m, compared to £90m under the original takeover deal. It said while overall borrowings would rise to £660m from £580m, the debt on the club’s books had halved to £135m.

.

Season of Discontent

Kop Holding‘s debts increased last week as Hicks and Gillett took out further loan funds to finance the construction of Liverpool’s new 71,000 stadium in Stanley Park. A spokesperson for Financial Dynamics, Tom Hicks’ City PR firm, insist that the actions of the Americans are in keeping with way the ‘vast majority of professional sports teams are run’. They claim any borrowings are supported by the club’s assets, meaning Liverpool’s cash flow to sign new players should not be affected. However, a number of national newspapers have reported that Liverpool are going to have to come up with a staggering £30m a year to meet loan repayments brought about by the club takeover and refinancing package.

A number of protests about the way Hicks and Gillett are running Liverpool have already been staged by the Kop faithful. A group of the club’s fans are going one step further however and urging 100,000 fellow supporter to raise £500m to buy the pair out. They would replace the current board with “member share” system, as operated by Barcelona and Real Madrid, which sees ownership of the club divided amongst members with an elected president. Rogan Taylor, a football academic from Liverpool University, has set up the ‘Share Liverpool’ plan. Taylor’s website (www.shareliverpoolfc.co.uk) urges fans to back his scheme claming, “we (Liverpool supporters) all know that, together, we are the heart and soul of Liverpool FC – why shouldn’t we also be its collective owners?”.

.

Learning From Example

Speaking in his new capacity of head of football operations, Pearson backed the new chairman’s pledge to build the club on an astute financial platform. He was also keen to differentiate Derby’s future approach from Liverpool and implement a financial model similar to Aston Villa. “You’ve got a situation at Liverpool and you’ve got a situation at Aston Villa” he said. “One is remarkably successful, the other is going down a different route. When you’re injecting debt into an institution that is Liverpool Football Club, you’re going to have problems. We’re looking at a completely contrary route to that.”

.

Knock-On Effect

The latest report on football finance is to be released by Deloitte this month and it is once again expected to demonstrate the financial dominance the Premiership enjoys compared with all other football leagues across the world. In the 2007 Football Money League report by Deloitte’s Sports Business Group partner Dan Jones outlined the positive effects takeover at a football club can have. “The wave of new owners are successful businessmen in their own right, often bringing past experience of operating large sports organisations to their new clubs,” claimed Jones. “Importantly, they are also likely to be more business focused in their approach to managing their clubs than may have been the case in the past” he continued.

Though the gap between the have’s and have not’s in English football seems to be increasing, another positive aspect of new money being invested in the game, is that it should trickle down to lower league teams. Better still, it makes teams outside the Premiership more investable propositions to overseas buyers, as English football’s profile grows and grows. QPR were taken over by a consortium headed by Renault managing director Flavio Briatore (Italian) last summer, with £22m invested into the West London club. The Hoops’ then £17m worth of debt was also wiped out as part of the buy out. Then in December 2007, the world’s fifth richest man Lakshmi Mittal (Indian), bought a 20% holding in Queens Park Rangers alongside F1 chief Bernie Ecclestone. Fellow Championship side Southampton were also a reported target for foreign investors last winter.

.

More To Follow

At Fratton Park it could be a case of one in, one out after Alexandre Gaydamak, the Franco-Russian owner of Portsmouth, put the club up for sale this week. One of the main reasons he purchased the club about 18 months ago was the possibility of building a 36,000 seater stadium in the city’s dockyards, turning the site of Pompey’s current ground into 500 houses. As the project continues to struggle to gain momentum, Gaydamak has grown increasingly frustrated. During this time however, the club have developed well on the pitch and he could expect to receive about £60m for his stake. A healthy profit on what he invested, thought to have been an initial £15m to secure 50% of the club.

The landscape of English football has completely changed since the invasion of foreign investors in to the game. While various individuals and consortiums from overseas are able to finance deals to bring the best players to these shores, inward investment will be welcome by clubs and fans alike. The question is, will such frivolity leave the Premiership to pay the ultimate cost in the long run? The laws of business average suggest that boom is almost inevitably followed by bust in any volatile industry such as football. The culture of securing multi-million pound loans on English clubs’ heads is certainly a worrying trend, despite the Premiership current decadence.

Add Sportslens to your Google News Feed!